Open Banking: How Does It Work? Benefits + Challenges

Imagine a world where your financial data moves between banks without compromising security, where you have full control over your choices, and where innovation speeds past any limits or boundaries. Thanks to the concept of open banking, this is the reality we now live in.

The open banking ecosystem allows customers to explore the potential of an interconnected financial future. It promotes collaboration and consumer empowerment while strongly focusing on security and data privacy.

What is open banking?

Open banking, also known as open bank data, is a practice that enables secure interoperability in the banking industry. It gives third-party service providers access to customer banking data and transactions via APIs, allowing them to offer personalized services and expand their range of financial products.

Through open banking, digital banking platforms gain the ability to securely access and share customer financial data across institutions, offering a holistic view of accounts, transaction data, and financial health. As a result, banks are no longer the isolated institutions of information they used to be.

Open banking has allowed financial service providers to unlock their vaults and share data responsibly. Banking as a service (BaaS) solutions make this happen by integrating financial products into non-financial service businesses using application programming interfaces (APIs).

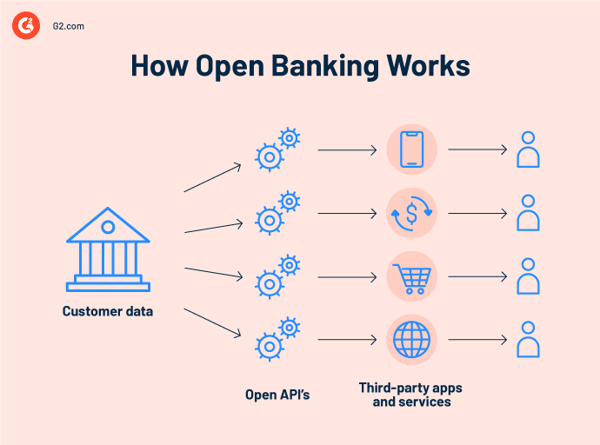

How open banking works

Open banking’s primary goal is to increase competition, innovation, and consumer choice in the financial services industry. It enables different industries to offer a variety of banking products and services in an interconnected, efficient manner.

Open banking uses financial data APIs provided by banks and other financial institutions to grant secure access to customer data. For example, a bank’s API integrated into a ride-sharing platform lets users pay for their rides from their bank accounts.

This cross-industry collaboration demonstrates the way open banking has the potential to reshape our interactions with the various services we use in our daily lives.

The following are the steps to an ideal open banking process.

- APIs: Banks and financial institutions develop open banking APIs that share data and functionalities with authorized third-party providers. This enables secure communication and data exchange between the bank database and third-party applications.

- Customer consent: Account holders must give their banking institutions explicit consent for sharing their financial data with third-party providers. This permission is typically given through a secure authentication process. Customers can specify which personal data they choose to share.

- Data access and sharing: Once consent is established, third-party financial service providers access specific financial data like account balances and transaction history. This data is used to offer personalized services, such as budgeting tools, debt management, and investment advice.

- Secure communication: Banks and financial institutions implement strong security measures, including encryption, authentication, and authorization protocols, to ensure that customer data remains confidential.

- Regulation and standards: Guidelines establish consistency, security, and interoperability across different financial institutions and third-party providers.

A brief history of open banking

Open banking was first introduced in 2015 with the launch of the payment services directive 2.0 (PSD2) in Europe. The concept facilitated a shift in the mindset of banks from acting as data stewards to looking at their customers’ data as useful assets.

Although financial services firms are now more likely to offer up their data sets, the rules set by PSD2 explicitly give the consumers the power to share – or to not share. There are informed consent stipulations in PSD2 that require banks to tell their customers exactly which data they’re granting the bank permission to share.

Open application programming interfaces are publicly available APIs that developers use to access backend data. They typically rely on the insights in that data to structure product development strategies to address the needs revealed.

The term “open APIs” when it comes to usage in the financial services industry is a bit of a misnomer, as these APIs aren’t truly open. The rules and regulations in PSD2 require that each developer using an “open” API is vetted and monitored, guaranteeing that data is used correctly.

Key principles of open banking

These principles collectively define the foundation of open banking and guide its implementation to ensure customer trust, data security, competition, and improved financial services.

- Access to customer information: Open banking involves real-time sharing of data, including statements and transactional data, from a customer’s bank account with other authorized financial service providers. It allows for a more comprehensive and up-to-date overview of a customer’s financial situation than traditional models.

- Initiation of real-time payments: This means that third-party organizations can initiate payments directly from the customer’s bank account (with their consent). The principle provides the convenience of online payments, and funds transfer through digital banking platforms and apps.

- Access to product and service information: Open banking informs its customers about products and services provided by different financial institutions. This lets customers easily compare offers, make informed decisions, and choose the best solution for their needs.

- Secured payment flows: Open banking ensures confidentiality, integrity, and authenticity of transactions. It implements comprehensive security measures to protect the sensitive data exchanged between parties. Encryption, authentication protocols, and cybersecurity practices safeguard payment flows to prevent unauthorized access.

- Transparency and customer consent: Open banking promotes transparency by guaranteeing that customers know how their data will be used. It prioritizes customer consent and control over their data, building trust among customers, financial institutions, and third-party providers.

Open banking use cases

Open banking has given rise to a wide range of use cases that make use of the shared data between financial institutions and third-party providers. Read on for a few examples.

- Personal finance management: Third-party applications use BaaS solutions to aggregate data from multiple financial institutions via APIs, giving users a comprehensive view of their financial health. These apps offer spending analysis and recommendations for better financial management.

- Digital payment solutions: These tools pave the way for direct payments and transfers from third-party apps, simple peer-to-peer payments, bill payments, and transfers across different accounts and banks.

- Credit scoring and loan approval: Using a wider range of data to assess creditworthiness and offer accurate loan approvals particularly benefits individuals with limited credit history.

- Real-time expense tracking: Open banking allows for instant budget tracking and notifications for account activity. Users can receive alerts for large transactions, low balances, and unusual spending patterns.

- Account aggregation: This feature lets users access and manage loans, credit cards, checking, and savings accounts within a single banking app or digital banking platform for clear financial management.

Benefits of open banking

Open banking transforms the financial landscape by promoting competition, innovation, and customer-centric services. It gives individuals greater control over their financial data and choices and benefits both consumers and the banking industry as a whole.

Some of the key benefits include:

- Increased competition. Open banking fosters competition by allowing new entrants, including fintech startups, to produce innovative financial products and services. This leads to a more diverse range of offerings and better pricing for consumers.

- Personalized services. Open banking can assist you in the creation of personalized financial services based on a comprehensive view of your financial situation. This can include expense tracking, credit score monitoring, and other solutions that cater to individual financial goals.

- Convenience. Customers can access and manage their financial data and services from various institutions in a single application. This streamlines the banking experience and eliminates the need to log in to multiple accounts.

- Better access to finances. Open banking can improve access to credit and financial services, especially for underserved populations. Alternative credit scoring models that consider a wider range of data help more people qualify for loans.

- Easier payments and transfers. Open banking facilitates seamless payments and fund transfers directly from third-party applications. This reduces the need to switch between different platforms for financial transactions.

- Data ownership and control. Customers have greater power over their financial data. They decide which data is shared and with whom, fortifying their privacy.

- Financial inclusion. Open banking can promote financial inclusion by providing individuals with limited access to traditional banking services the opportunity to use alternative financial products and services.

Limitations of open banking

While open banking offers various benefits, it also comes with risks and limitations. These need to be addressed to ensure that open banking remains secure, transparent, and beneficial for all stakeholders.

- Data security and privacy concerns: Sharing financial data between institutions and third-party providers increases the risk of data breaches and unauthorized access. Customers may be concerned about the security of their sensitive financial information.

- Uneven implementation: The implementation of open banking standards varies among different banks and financial institutions. Inconsistent APIs and data formats hinder smooth data exchange.

- Inequalities in access: Not all customers have access to, or are comfortable with, using digital tools and platforms. This can lead to inequalities in access.

- Risk of misuse: Third-party providers might exploit customer data for advertising or other purposes without proper oversight, potentially causing privacy concerns and customer dissatisfaction.

- Fraud and cybersecurity issues: Open banking could provide new avenues for frauds and cybercriminals to leverage vulnerabilities and conduct scams that target both consumers and financial institutions.

- Customer trust: Customers might be skeptical about sharing their financial data with third-party providers, especially if they aren’t adequately educated about the benefits and risks of open banking.

- Dependency on technology: Open banking heavily relies on technology infrastructure and APIs. Technical glitches, system outages, or cyberattacks could disrupt services and compromise customer experiences.

Data sharing in open banking: Boon or bane?

One of the potential concerns for customers is privacy with regard to data sharing. The more places your data is held, the more vulnerable. Consumers are more aware of security risks than ever before and have become more hesitant to hand over access to their data.

The fact that consumers have to explicitly accept all data-sharing requests should alleviate some of their issues about open banking. In addition, there’s a frequently updated list of regulated open banking third-party providers that must enroll with an open banking regulatory body to ensure that only regulated providers access consumer information. Uneasy consumers can consult the list to confirm whether the banking provider or fintech application they use is there.

Transaction data shared through open banking APIs is anonymized, meaning no personal information is attached to the data. Open banking’s use of APIs in lieu of screen scraping is another notch in the data safety belt.

Screen scraping involves the use of actual customer login details to gain access to their accounts. This increases the possibility of fraudulent activity, as login information can be hacked and used maliciously. Open banking, once again, does not engage in this practice which should set the consumers’ minds at ease.

Data types shared via open banking

The three most common types of financial data shared using open banking are:

- Payment requests track where requests come from, which vendor makes the request, and when the requests are made.

- Balance information is the customer’s balance, along with the date.

- Transaction data includes vital information like merchant name, purchase location, and purchase category.

Banks and fintech developers can use the information to create useful applications for consumers based on their personal data, such as their salary or spending habits. Consumers use the applications created as a result of their data – applications limited only by the creativity and ingenuity of the developers working on solutions for those consumers.

An example of open banking is HSBC’s Connect Money application, which allows customers to see all of their accounts from different banks within a single application. The app is a harbinger of things to come. Banks will soon be able to roll out applications in the same vein, and fintech can engineer applications that take advantage of the data on offer.

Best practices for open banking

Despite the risks and challenges associated with open banking, financial institutions and third-party providers can establish a secure, compliant, and user-friendly open banking environment that benefits all stakeholders involved. Applying best practices means open banking procedures always have:

- Robust security measures. Prioritize data security by implementing strong encryption, multi-factor authentication, and secure APIs. Regularly conduct security audits, vulnerability assessments, and penetration testing to address potential threats.

- User consent management. Communicate to users how their data will be used and shared. Obtain their consent before accessing or sharing their financial information with third-party providers. Allow them to easily revoke consent for data sharing by offering user-friendly interfaces that manage their preferences.

- Strong authentication. Make sure that secure authentication methods are in place for both users and third-party applications to prevent unauthorized access to sensitive financial data.

- API design and standards. Develop APIs according to industry standards and make them user-friendly, consistent, and well-documented. Provide comprehensive documentation for developers to facilitate integration.

- Regulatory compliance. Stay up-to-date with relevant open banking regulations, such as general data protection regulation (GDPR) in Europe or the Consumer Data Right (CDR) in Australia. Implement measures to comply with privacy, data protection, and financial regulations.

- Risk assessment and mitigation. Continuously assess and manage risks associated with open banking activities. Set up risk management strategies that address potential vulnerabilities and threats.

Open banking service providers

Several companies have tapped into the open banking market and already provide valuable services. Let’s take a look at some of these innovators.

- An AI chatbot that helps customers track spending, build credit, and reach their financial goals, Cleo never stores your banking information and keeps you on top of your money in a read-only format.

- Moneybox and Plum assist their clients with the process of saving and investing for greater understanding and customer satisfaction.

- Bringing all banking accounts and transactions into a single app, Cake provides market insights and cash-back options.

- Trustly is a payment method where payments go directly from one account to another without the need for app downloads or cards.

- Tully has helped over 13,000 customers build an online budget and learn more about their financial situation. It can also give you debt advice.

- Plaid is an intermediary between financial apps and banks. It allows app users to log in and share their financial data securely.

Future of open banking

The future of open banking is poised for dynamic growth, with several key trends on the horizon. As open banking continues to spread globally, a focus on standardization and interoperability will keep integration seamless across institutions. The expansion of services beyond payments and account information will create a holistic financial experience, while data-driven personalization through AI will elevate customer engagement.

Regulatory frameworks will evolve to address privacy concerns and technological shifts, and innovation between traditional banks, fintech firms, and other industries will give rise to integrated, user-centric solutions. Strengthened cybersecurity and fraud prevention measures will safeguard data integrity, while cross-border open banking initiatives and enhanced consumer education will shape a more inclusive and informed financial landscape.

Three things need to happen for open banking to become an unequivocal success:

- Consumers must buy-in. Open banking is still contingent on customers opting into data sharing.

- Traditional banks must embrace it. Traditional banks must fully embrace open banking and partner with fintech to deliver new products and more efficient services.

- Fintech providers have to recognize the potential. Solution providers need to understand the capabilities of open banking and actively pursue product development based on data gleaned from open APIs.

Say open sesame to a funtech future

Open banking stands as a pivotal transformation in the financial landscape, ready to usher in a new era of connectivity, innovation, and empowerment. As traditional barriers crumble, customers are no longer confined by the limitations of traditional banking models. Instead, they’re granted unprecedented control over their financial data, unlocking personalized services and seamless experiences tailored to their unique needs.

This evolution, driven by the harmonious collaboration between established institutions and agile fintech disruptors, has the potential to reshape how we perceive, access, and manage our money.

Learn more about the rise of digital transformation in banking and how it has truly benefited the secure way financial services operate today.