How to Conduct Small Business Financial Planning Effectively

As a small business owner, financial planning can feel overwhelming.

But financial planning is crucial for small businesses. Not only does it provide you with an entire overview of your financial health, but it helps you figure out how to grow and develop your business as efficiently as possible.

There are many budgeting and forecasting software for small businesses that can estimate future revenue and expenses by planning the financial resources you need.

What is small business financial planning?

Small business financial planning is the process of reviewing revenue, turnover, assets, capital, inventory, and anything else concerning a business’s financial affairs. It summarizes the financial health of a business and outlines its financial goals for the future.

Whether it’s a long-term investment plan or a short-term plan for revenue growth, your financial plan will be clear as to what your goals are and how you can plan to achieve them.

In this article, we’ll discuss everything you need to know about financial planning as a small business. We’ll cover what financial planning is, whether you need a financial advisor, and how to create a solid financial plan for your business.

We’ve also got some valuable tips for financial planning as a small business and an overview of a few essential things to bear in mind when creating a financial plan.

Why is financial planning important for a small business?

You just finished registering your business through a qualified registered agent. Now, you’ve got a lot on your plate running the actual business, and finance is a complex subject. Here are a few reasons to plan your finances:

- Understanding your financial situation: As a small-to-mid-size business, it’s important to have clear oversight of your financial health. With oversight of your finances, you’ll know what resources you have available, what areas of your business are doing well, and what areas need improvement.

- Identifying areas of growth: Financial planning is a great way to identify areas of growth. It shows you where you can improve your business and how to spend your money. And as a small business owner, you need to make sure you’re spending your money as efficiently as possible.

- Thinking about the long term: Financial planning is the perfect opportunity to think about the long-term growth of your small business. You can create a step-by-step plan to get from where you are now to where you want to be.

Do you need a financial advisor as a small business owner?

A financial advisor helps you make informed decisions about what to do with your money and other assets.

But the question is: do you need one? In short, no. You don’t need a financial advisor. But there are benefits to using one if you’re running a small business.

These include:

- Saving time: With a financial advisor taking care of your money, you can spend less time managing your finances and more time running your business.

- Evaluating market trends: Financial advisors know the industry inside and out. They’re on top of all the latest economic trends that influence the way you run your business.

- Saving money: Using a financial advisor isn’t cheap, but it can help you save money in the long run. With such a wide range of industry knowledge, they’ll find ways you can cut costs that you might not have considered.

Even though a financial advisor isn’t a necessity, there are certainly reasons you should think about using one as a small business owner. It might seem like a lot of money to spend, but it’ll save you both time and money.

How to craft a strong financial plan for your small business

Unfortunately, there isn’t a one-track system to create a successful financial plan. Every company is different, which means financial plans change from business to business. But there are some best practices you can follow to make sure your financial plan is as strong and stable as possible.

Identify any capital required

First things first, you must identify the capital you need to help your business grow. Knowing what capital you need helps you plan your finances more efficiently and maximize your resources.

Not to mention, it allows small business owners to figure out how much they have (in terms of money, resources, and assets) in comparison with what they need.

So how can you identify the capital you need? First, you need to figure out what capital you already have. This will give you a solid starting point to find the capital you need to get to where you want to be.

Spend some time reviewing what your business already has, and go from there. Once you know what resources you have available, you can think about what capital you need.

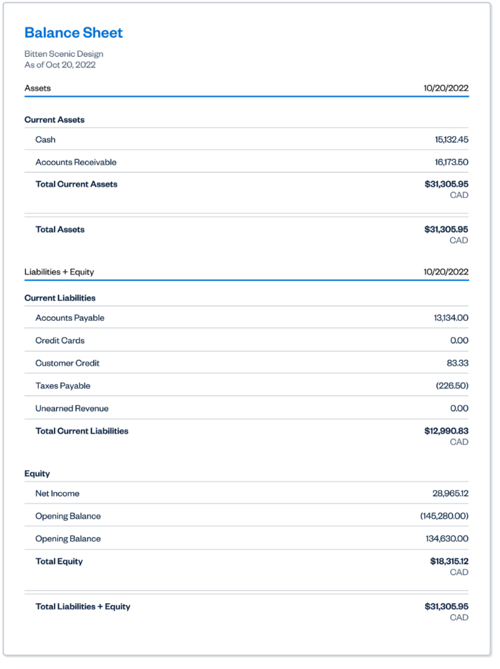

Create a balance sheet

A balance sheet reveals your company’s assets, liabilities, and equity. It adds your liabilities (any debt or losses) to your equity (what your business is worth) to determine the value of your assets.

Here’s an example of a balance sheet in action:

When combined with other documents, such as an income statement or cash flow statement, small business owners get a pretty clear picture of their financial health.

How can you create a balance sheet? Follow these steps to create your own:

- List all your assets along with their current market value

- Outline all your debts and liabilities

- Subtract the value of your liabilities from the total value of all your assets

What you’re left with is the equity (net worth) of the business.

To keep things simple, the free balance sheet template is also available.

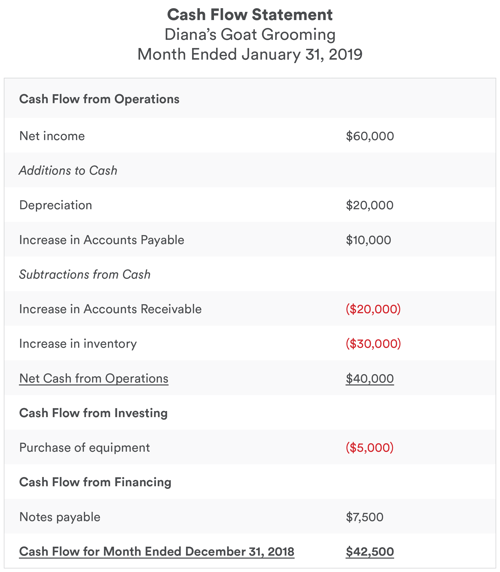

Produce a cash flow statement

As a small business owner, it’s important to keep on top of your operating cash flow.

Having a healthy cash flow is an important part of running a successful business. It gives you a buffer for emergencies, allows you to pay your employees on time, and provides you with the funds you need to run your business.

To keep track of your cash flow, you need to create a cash flow statement. A cash flow statement is a financial document that summarizes all the cash going in and out of your company. It shows how the company’s operations are running, where money is coming from, and how it’s being spent.

Here’s an example:

With a cash flow statement in place, you can easily measure how well your company manages its cash position.

Project your future earnings

Part of the financial planning process involves projecting your future earnings. The most efficient way to do this is to create an earnings forecast. Based on how your company has performed in the past, you make predictions about future earnings over a specific period.

In other words, you use past data to predict your future earnings.

But how is this useful for a small business? There are a few ways:

- Find your future goals: Forecasting helps you figure out where you want your company to be further down the road and map out the journey to get there.

- Align your team: When you conduct an earnings forecast, you create a goal for everyone to work toward. By doing this, you align your company to hit certain targets.

- Show investors your roadmap: As a small business, you might be thinking about getting investors involved. An earnings forecast outlines the course of your business development, which investors will certainly want to see.

Financial planning considerations small businesses make

For your outline, you only need bullet point descriptions of content you plan to write. When it comes to financial planning, there are certain considerations small businesses need to keep in mind that large companies won’t.

Or if a large corporation needs to take the same consideration, they’ll probably review it from an entirely different perspective. Let’s take a look at some of the financial planning considerations you need to be aware of as a small business owner.

1. Retirement planning

We know what you’re thinking. Isn’t retirement planning important for every business, not just small businesses? You’re right. Every business owner should think about retirement planning. But small business owners need to do it sooner rather than later.

Large corporations have retirement planning and processes in place for employees. But as a small business owner, this job is up to you.

Here are a couple of things to think about when it comes to retirement planning:

- Distribute your finances: Preparing for retirement involves saving, distributing, and investing your money. The most common investments are usually retirement accounts, which allow you to grow your money with tax benefits and interest. If you’re giving away any assets to friends or family, be sure to check whether they are tax deductible.

- Create a will or trust: Retirement planning takes life expectancy into account. Having a living will or trust in place will protect your assets in the event of an accident or incapacitation.

Get your ducks in a row as soon as possible to make sure you can enjoy a long and happy retirement. The sooner you factor it into your financial plan, the more chance you will reach your goal.

2. Risk management

Every business faces risk. Whether that’s losing market share to a new competitor or taking a hit in product sales, there’s always a possibility things won’t go to plan.

But the potential loss for a small business can be detrimental if you don’t have a risk management plan. A risk management plan outlines the possible financial issues your business might face and how to mitigate them. This will ensure that you’re prepared for the worst-case scenario.

And if you’re thinking about getting an investor on board, they’ll be pleased to know you have a plan to tackle any challenges that come your way.

So when it comes to your financial planning, make sure you think about integrating a risk management plan, too. It might seem like a lot of effort, but if things don’t go your way, you’ll be glad to have a plan of action in place.

3. Tax planning

No one wants unexpected fines and charges, especially if you’re a small business. A large fine from the authorities could be the difference between a successful year or cutting costs across the company.

Fortunately, this is where tax planning can help.

Tax planning involves organizing your finances in the most tax-efficient way. It identifies areas where you can save money and claim money back. It also reduces your likelihood of getting unwanted fines. As a result, you can put more money back into your business. And as a small business, the more money you can invest in your growth, the better.

If you’re not sure where to start with tax planning, don’t worry. There’s a lot of tax software out there that can help you out.

Financial planning tips for small businesses

We’ve covered a lot of ground so far, so let’s wrap things up by looking at four of our most useful financial planning tips for small businesses.

1. Review your operating expenses

Operating expenses are costs incurred from your core business operations. For example, the rent you pay for your workspace or your inventory costs.

Taking stock of your operating expenses allows you to identify the cost of running your business, which is vital for financial planning. With this information, you can work out your net profit. This means you can figure out how much money you have leftover after all your expenses are settled.

And as a small business, keeping on top of your net profit is the key to success. Without an SMB accounting system, you won’t know what money you have available, which could result in overspending.

If you’re not sure where to start, there are plenty of expense management platforms out there to make the job easier.

2. Outline your business goals

Clearly outlining your business goals gives your financial planning direction. When you have company goals in place, you can tailor your financial plan to achieve those goals.

Imagine your business goal is to increase your annual turnover by 10% within the next year. As a result, your financial plan outlines how you can cut costs on production to offer a lower price to consumers.

Take a look at the pricing page from ActiveCampaign. This software is entirely online, meaning it can offer services for a very reasonable price.

Offering a lower price has a higher chance of increasing your conversions and getting a higher annual turnover.

Make sure you’re clear on what your company goals are before you create a financial plan. By aligning business goals with the financial planning process, you have a higher chance of achieving them.

3. Consider your funding options

If you haven’t already, make sure you explore the loans and grants that are available to small businesses.

Securing funding can help you reinvest your capital, grow your company, and improve your financial health. The good news is that there’s a variety of funding options out there for small businesses.

Organizations such as the U.S. Small Business Association and the U.S. Government (among others) offer funding options for small businesses. You’ve got nothing to lose by applying, so take a look at what’s out there.

4. Build your credit score

If you consider funding or investment, you don’t want poor business credit to be a problem. Investors and shareholders aren’t going to invest in a business with a bad credit score. It could also cause problems with acquisitions and other business transactions further down the road.

So what can you do to improve your credit score and keep it strong? Pay your bills on time. Don’t miss credit card payments. Don’t accept any loans with interest rates you can’t afford. This will make sure your credit rating stays above the line.

When cents make sense

You’ve now got a pretty solid understanding of small business financial planning and some best practices to follow when creating a financial plan.

Now it’s time to put all this knowledge into practice.

If you’re worried about taking on this arduous task, don’t be. There are ways to make the process easier to manage. With the right platform, you can streamline the planning process and keep everything stored in one location.

Take a look at the best financial analysis software for small businesses to monitor your financial performance efficiently.