How To Build an Accounts Receivable Automation Business Case

Imagine a growing business constantly extending free credit to customers but lacking the systems to efficiently collect payments.

This, unfortunately, is the reality for many companies struggling with accounts receivable (AR).

At its core, AR refers to the claims a business has against customers who have already received a product or service but are yet to pay for it. While extending credit to customers is common practice, particularly in the B2B realm, poorly managed AR processes can lead to cash flow issues and, in severe cases, business failures.

The good news is that automation can revolutionize AR processes.

This blog explores the top challenges businesses face, how automation tackles them, and a step-by-step guide to building a winning case for AR automation in your company.

Introduction to accounts receivable automation

Unpaid or late invoices affect all businesses, but it’s often medium-sized or smaller businesses that suffer the most.

This is because they typically have less power to enforce payment terms on their customers and fewer sources of capital to rely on when they’re consequently short on cash.

Source: Centime

Late payments aren’t a new challenge for businesses.

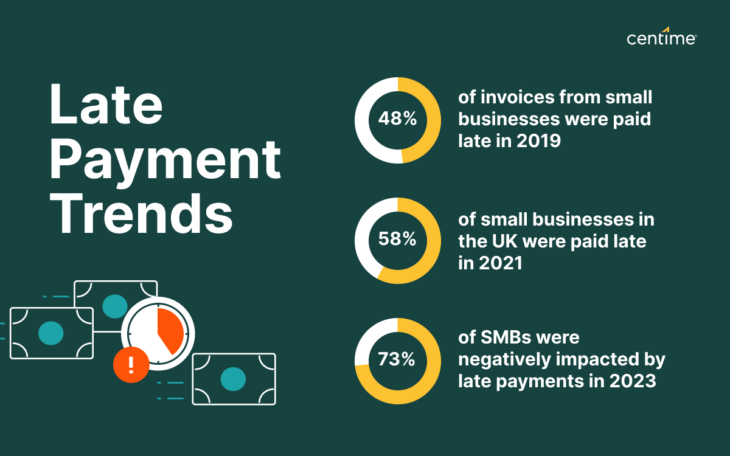

Xero’s 2019 The State of Late Payments report estimated that 48% of invoices from small businesses were paid late, while in 2021, UK-based Barclays Bank found that 58% of small businesses in the UK were still waiting on customer payments.

More recent numbers make it clear that the issue of late payments isn’t going anywhere. As of 2023, QuickBooks found that 3 out of 4 SMBs were negatively impacted by late payments. Even more concerning, 40% of those organizations could shut down in the next 12 months because of late payments.

Don’t be fooled by the simple term “accounts receivable.” Poor AR management can cripple a business. In comparison, efficient AR processes safeguard cash flow and minimize bad debt.

Unfortunately, most finance teams juggle multiple priorities and are confined by limited resources. This leads them to neglect critical AR steps.

Luckily, this is where AR automation software steps in.

AR automation streamlines invoicing and payment collection processes by enabling finance teams to track invoices automatically, send reminders near due dates, and reconcile payments. Automation reduces the time and effort required to manage receivables by making AR a more consistent and organized process.

Top 4 accounts receivable challenges

Manual accounts receivable processes are a headache for most finance teams. It leads to siloed and disorganized customer communications, lost or incorrect invoices, and, eventually, overdue payments.

Let’s look at the top challenges of managing AR manually and how these issues impact businesses.

Source: Centime

Delayed payments

In a recent late payment survey from Chaser, only 13% of respondents reported that their business is paid on time or early, meaning nearly 9 out of 10 businesses have to deal with late payments.

Delays of a day or two won’t matter in the grand scheme of things.

The problem lies in chasing up overdue payments by 30, 90, or more days. When a business pays its suppliers for inputs on time but has to wait months for payments from the customers that received these inputs, the outcome is a major cash flow crunch.

It won’t be long before supplier payments are late as well, and they stop supplying goods and services. This will ultimately put a company out of business.

While you can sometimes rely on financing to fill the gaps, this route requires added costs, which isn’t ideal when you’re low on cash.

High operational costs

Poorly managed accounts receivable have the potential to cause huge financial disruptions and even losses. So, it stands to reason that most businesses make a significant effort to manage them well. That said, it’s no walk in the park.

53% of companies report spending 4 hours or more managing AR every week. It’s a significant overhead cost for finance teams — teams that could spend the time working on more strategic activities that add value.

There’s also the question of scalability.

As a company grows and invoice volume increases, finance teams become bogged down in manual AR tasks, requiring them to hire additional staff to execute timely collection and chase bad debts. This constant staffing need can limit the company’s ability to scale efficiently.

Beyond just hiring costs, scaling AR teams in a competitive talent market is a challenge. This can lead to backlogs of uncollected invoices as AR teams struggle to keep up with ballooning outstanding invoices.

Human errors

Even if scaling wasn’t a challenge, with the human factor in manual processing, there remains some risk of error. It may be a minor risk, but even a single error within a thousand processing instances can be expensive.

Whether it’s with data entry, forgetting to follow up on overdue invoices, or inconsistent messaging when communicating with customers, human error will inevitably creep into AR processes. Each error contributes to late payments, cash flow challenges, and frustrated customers.

Cash flow issues

The Chaser Late Payments survey contains another startling statistic: it was found that over 35% of invoices are late by 30 days or more. It’s not hard to see how such delays can cause distress.

After all, where is the missing money going to come from? Will a business resort to paying its suppliers late, damaging supplier relationships? An expensive loan from the bank, then?

For smaller organizations that operate day-to-day with limited sources of capital, overdue invoices can become a significant strain.

That said, cash tied up in uncollected invoices also drains large businesses. It can lead to financing costs. As a result, profitability takes a hit, and investments are delayed, limiting business growth.

5 key benefits of AR automation

Even if businesses throw unlimited resources at accounts receivable, there are practical limits to what manual processes can achieve compared to automation.

Let’s explore the benefits of AR automation and how automation increases efficiency and accuracy, leading to reduced bad debt and improved cash flow.

Source: Centime

1. Increased visibility

All centralized data platforms, including accounts receivable platforms, share a common benefit: consolidating all data into a single location greatly increases visibility. This provides AR teams with real-time access to up-to-date data, improving the accuracy of their AR reporting.

Visibility also brings control. If it’s easy to view a customer’s outstanding invoices and payment history, executing a proactive collection strategy that accounts for past communications with the customer also becomes more manageable.

2. Enhanced efficiency

By keeping all accounts receivable data in one centralized location, you gain the opportunity to automate AR processes.

Automation efficiently streamlines the manual, repetitive tasks involved in receivables management — from generating initial invoices to composing and scheduling payment reminder emails.

A PYMNTS survey found that 79% of teams that adopt AR automation report increased efficiency. That means smaller headcounts and less pressure to hire additional AR professionals when a team scales since automated processes can scale effortlessly.

3. Improved cash flow

One major benefit of automating accounts receivable is the consistency it creates. Automate AR processes, and you can consistently follow up on invoices month in and month out. After all, all it takes is the push of a button.

The net result: improved cash flow.

Businesses that follow up on 90% or more of outstanding payments will likely be paid within seven days of the invoice due date.

This consistency also lowers days sales outstanding (DSO). So, AR automation ensures you have more cash on hand to invest back into your business.

4. Reduced bad debt

Visibility and automation have a net financial benefit, too. The 2022 PYMNTS survey found that 62% of teams that adopt AR automation report lower DSO, while 49% report lower delinquency rates.

Needless to say, reducing bad debt means more money in a company’s bank account and higher profits. It also reduces the risk of financial failure due to bad debts piling up.

A lower DSO also takes pressure off teams because it implies a more efficient collections process that doesn’t drain resources, so your team can focus on more engaging work.

5. Strengthened customer relationships

It’s important to note that inconsistent manual AR processes affect customer relationships.

No customer likes back-to-back calls from different members of a finance staff. Automation prevents these mistakes by making customer communications more consistent, reliable, and organized.

The standardized nature of automated AR means customers are regularly updated on their outstanding payments, preventing unpleasant surprises. What’s more? AR automation frees up time so staff can focus on white-glove customer service rather than putting out fires.

How to build a best-in-class business case for AR automation

It’s not hard to see why AR automation benefits invoice processing and collection and why that, in turn, has major bottom-line benefits for most businesses. However, changing an existing process that works is never easy.

Changing the status quo is even tougher when it’s a core financial process. This is why it’s important to consider how to construct an ideal business case for accounts receivable automation.

In this section, we discuss four key steps you can take to build a business case for AR automation. We’ll also share other best practices to round out your business case and bring your decision makers on board.

Source: Centime

Step 1: Define your business goals

Consider your company’s financial goals for the year ahead and your CFO’s top priorities.

Reducing bad debt and improving cash flow within this goal set shouldn’t surprise you. AR automation provides quick wins for both goals.

That said, goals such as cutting costs, scaling rapidly, or focusing more on analytics can also be achieved through AR automation, as automation drives lower finance spend, enables scaling, and delivers deep analytics.

Step 2: Identify pain points

Now that you’ve identified your “why” for AR automation, it’s time to build a financial case around how AR automation’s features and benefits address these pain points.

Explain how automation reduces DSO and unpaid invoices, reduces bad debts, and improves cash flow. It’s also worth mentioning that automation empowers your team to scale efficiently and handle increased workloads without constant hiring pressure.

Additionally, it can enhance the customer experience by streamlining communication and ensuring timely reminders.

Step 3: Calculate your return on investment (ROI)

Calculating the ROI on AR automation can be challenging. There are many touchpoints to consider, and certain benefits of automation are hard to turn into actual numbers.

It helps you use AR automation ROI calculators that will do much of the hard work for you. Simply enter your average payment terms, the number of collections, the estimated trailing 12 months AR, and an aging report for your current receivables.

The calculator will use these data points to estimate your annual ROI and cash flow gain, which you can present as part of your AR business case.

Step 4: Research and propose a solution

To choose and configure an AR automation solution that fits your company’s requirements, start by listing the key AR functionalities you need.

This could include real-time analytics, the capability to integrate with your existing accounting system, and data security protections.

- What accounting systems do you integrate with?

- What integration routes do you support? (e.g., file-based, etc.)

- Can the solution be customized for our unique needs?

- What is your customer service model?

- Do you have customer testimonials or case studies to share?

- What is your NPS score?

Weave a compelling story in your AR automation business case

Now, it’s time to craft a powerful narrative showcasing the value of AR automation in your business case.

With all the evidence gathered in the steps above, consider illustrating a scenario where implementing AR automation transforms the finance department from a cost center into a strategic partner that can rapidly scale to support growth.

Also, draw on specific pain points, such as high DSO, with a before-and-after comparison showcasing the possible tangible improvements. Use real data or projections from the ROI calculator to make your case compelling.

Other than this, understand that the battle your business faces with accounts receivable is not unique.

Organizations deal with slow payers and bad debt every day. And many have implemented accounts receivable automation to minimize these challenges.

Including case studies demonstrating the success of AR automation is another tactic to further bolster your business case. It allows decision-makers to see AR automation in action.

For example, look at this AR automation case study for JobGet. It demonstrates how the team at JobGet reduced the number of overdue invoices while simultaneously spending less time on AR week to week.

Source: Centime

The future of AR automation

Like any other technology solution, AR automation continues to improve and mature. There are plenty of new and improved functions, and even more on the horizon. These are a few of the core improvements currently in the AR scene:

- Payment portals offer a centralized and more user-friendly platform for customers to make payments. It also improves controls for finance teams and boosts the payment experience for customers.

- Autopay automates the payment process so customers can pay right when an invoice is issued, limiting the need for manual intervention. Autopay saves time and effort for finance staff, contributing to improved cash flow management and reduced instances of late payments.

- Predictive analytics empower finance staff to make data-driven budgeting and cash flow decisions. This includes forecasting customer payment behavior, optimizing credit terms, and identifying financial risks.

- Artificial intelligence (AI) can drive even greater AR automation by providing suggestions for complex workflows. AI also helps to personalize customer interactions for an improved customer experience.

- Cash management focus can be created by blending accounts payable (AP) and AR processes under a single tool. With this, vendors can help organizations develop a more robust cash planning strategy.

The bottom line: embrace AR automation, unlock growth

Building a business case can, admittedly, be challenging. However, you can leverage the insights from this guide to build a compelling business case and secure the tools your finance team needs to thrive.

Embrace AR automation and watch your receivables headaches fade, your cash flow flourish, and your finance team breathe a sigh of relief.

Explore the latest technology-driven solutions for working capital management, and maximize your financial resources.

Edited by Supanna Das